Central California Builder Incentives

July 7, 2025

Central California builder incentives are creating a tale of two markets, with aggressive concession packages in the Central Valley contrasting sharply with premium no-incentive strategies along the coast. As mortgage rates remain elevated and buyer affordability becomes increasingly strained, understanding these regional differences is crucial for both buyers and real estate professionals.

The Central California Landscape: A Regional Divide

The Central California housing market is experiencing a fundamental shift driven by divergent builder strategies. While Kern and Fresno counties deploy substantial incentive packages to maintain sales momentum, San Luis Obispo County builders continue commanding premium prices without concessions.

Key insight: Central California builder incentives are effectively reducing net home prices by 3-8% in the Central Valley, creating distinct market dynamics within the region.

Why Central California Builder Incentives Vary Dramatically by County

The Driving Forces Behind Incentive Strategies

In response to softer market conditions and weakening consumer confidence, homebuilders across Central California are taking vastly different approaches:

Central Valley Strategy: Aggressive incentive packages to maintain volume and affordability. Coastal Strategy: Premium positioning leveraging inherent desirability and limited inventory

Primary Incentives Categories

Mortgage Rate Buydowns

- Builders paying portions of buyers’ interest for 1-2 years

- Some offering rates as low as 2.99% in the first year

- Directly countering the affordability crisis from current market rates

Substantial Closing Cost Contributions

- Many builders cover 3-6% of the purchase price in closing costs

- Reducing buyer cash requirements by $15,000-$40,000 on average homes

Value-Added Packages

- Complete appliance packages and design center credits

- Adding $8,000-$15,000 in immediate value

Central California Builder Incentives: Kern County Market Impact

Kern County’s Central California builder incentives are transforming the market from a pure seller’s market to a more balanced environment, with 39.3% of homes selling below asking price.

Leading Kern County Builder Incentive Programs

Lennar – Most Aggressive Central California Builder Incentives

- Rate Buydown: 3.99% FHA promotional rate (5.024% APR)

- Price Reduction: Up to $40,000 direct price cuts

- Appliance Package: Refrigerator, washer, and dryer included

- Net Impact: Average sales price declined to $389,000

John Balfanz Homes – Local Leader in Central California Builder Incentives

- Closing Costs: $24,835 covered when using Balfanz Mortgage

- Seller Concessions: Up to 6% with preferred lender

- Rate Buydown: 3.25% first-year rate with 2/1 buydown program

- Total Savings Potential: $35,000-$50,000

K. Hovnanian Homes – Structured Long-term Savings

- Tiered Buydown: Year 1: 2.99%, Year 2: 3.99%, Years 3-30: 4.99%

- Flex Cash Equivalent: Substantial cash-back options

- Net Impact: $25,000-$35,000 in first-year savings

Kern County Market Implications

For Buyers: New construction with Central California builder incentives now offers 8-12% better value than existing homes

For Sellers: Must compete against builder incentives, leading to increased negotiation and longer market times (48 days average)

Market Trend: Median sold price of $374,905 represents moderated growth (+2.2% YoY) due to builder pricing strategies

Fresno County:

Despite being classified as “very competitive,” Central California builder incentives in Fresno County are enabling 47.2% of homes to sell below asking price, indicating increasing buyer leverage.

Leading Fresno County Builder Incentive Programs

De Young Properties – Comprehensive Financial Solutions

- Financing Incentives: Up to $43,000 in total savings potential

- Rate Buydowns: As low as 4.99% available

- Closing Cost Coverage: Substantial contributions through De Young Mortgage

McCaffrey Homes – Process-Focused Incentives

- Integrated Approach: Design Center and Mortgage team coordination

- Current Promotions: Active incentive programs

- Streamlined buying process with built-in affordability measures

LGI Homes – Event-Driven Savings

- “Sunsational Summer Savings”: Special event through August 10, 2025

- Triple Benefit: Special pricing + rate reductions + builder-paid closing costs

- Making homeownership accessible despite “strong demand and limited inventory”

Fresno County Market Impact

For Buyers: Incentive competition between builders creates opportunities for significant savings

For Sellers: 30-day average market time (+29.2% YoY) reflects builder competition impact

Market Trend: Median price of $420,009 (+3.2% YoY) shows controlled appreciation due to Central California builder incentives

San Luis Obispo County:

Unlike the Central Valley, San Luis Obispo County builders maintain premium pricing without offering substantial Central California builder incentives, yet still see 51.6% of homes sell below the asking price, indicating sophisticated buyer negotiation in high-value markets.

Premium No-Incentive Strategy

Midland Pacific Homes

- 40+ years of distinguished neighborhood development without incentive reliance

- 4 communities with 21 homes maintaining full pricing power

Coastal Community Builders

- 35+ years emphasizing craftsmanship and satisfaction without price concessions

- 2 communities with selective inventory at full asking prices

Trumark Homes & Shea Homes-Trilogy

- Limited communities maintain exclusivity without builder concessions

- Premium positioning strategy in desirability-driven market

Why San Luis Obispo Avoids Builder Incentives

- Limited developable land creating natural supply constraints

- Coastal lifestyle premium that buyers willingly pay without incentive requirements

- Buyer demographic less sensitive to mortgage rate fluctuations

- Investment demand from outside the immediate area

Strategic Analysis:

The New Market Reality

Two-Market System: Kern and Fresno counties create significant value advantages for new construction, while San Luis Obispo’s no-incentive strategy maintains premium positioning.

Central Valley Price Discovery: The percentage of homes selling below asking in Kern (39.3%) and Fresno (47.2%) counties reflects builder incentive competition, which forces down effective prices.

Coastal Market Strength: San Luis Obispo’s 51.6% below-asking rate occurs without builder incentive pressure, indicating pure market negotiation dynamics.

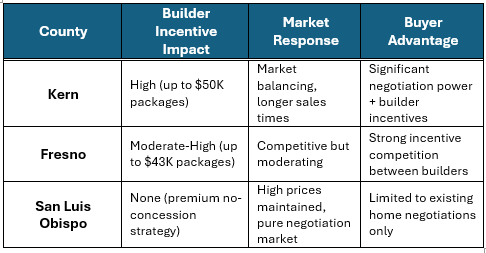

County-Specific Impact Comparison

Strategic Recommendations:

For Buyers

Central Valley Opportunity: Kern and Fresno counties represent the best value opportunities in the current market. New construction with incentive packages often provides 8-15% better total cost of ownership than existing homes.

San Luis Obispo Strategy: Without Central California builder incentives available, focus on negotiating with existing home sellers and emphasizing lifestyle value over financial incentives.

Regional Comparison: Consider Central Valley options if seeking maximum affordability, or San Luis Obispo if prioritizing coastal lifestyle without expecting builder concessions.

Timing Consideration: Central Valley incentive levels are likely to continue through 2025, while San Luis Obispo’s no-incentive strategy appears sustainable due to market fundamentals.

For Sellers

Central Valley Competition: In Kern and Fresno counties, sellers should price competitively from listing to compete with Central California builder incentives. Extended market times reflect this competitive pressure.

San Luis Obispo Advantage: Benefit from no builder concession competition but still face sophisticated buyers who negotiate aggressively (51.6% below asking).

Value Differentiation: Highlight advantages over new construction (established neighborhoods, mature landscaping, no construction delays) – especially important in Central Valley where builders offer significant incentives.

For Real Estate Professionals

Market Expertise: Understanding builder incentives is crucial for providing accurate market analysis and pricing strategies.

Client Advisory: Educate clients on regional differences and how builder incentives impact comparable sales and market valuations.

Appraisal Considerations: Factor in builder incentive impacts when conducting market analyses and determining property values.

The Future of Central California Builder Incentives

Central California incentives in Kern and Fresno counties will continue to be the primary market driver through 2025, effectively controlling price appreciation and maintaining transaction volume in the Central Valley. Meanwhile, San Luis Obispo’s strategy of maintaining premium pricing without concessions appears sustainable due to the area’s inherent desirability and limited supply.

This creates a tale of two markets: incentive-driven affordability in the Central Valley versus premium positioning on the coast. The Central California housing market is being actively shaped by divergent builder strategies rather than purely by supply and demand forces.

Understanding these regional differences and leveraging appropriate strategies will be crucial for success in each county’s distinct market environment. Central California builder incentives represent a fundamental shift in how the housing market operates, with implications that extend far beyond individual transactions to shape entire regional market dynamics.

Leave a Reply Cancel reply

follow us on

@ccappraisals