Understanding the Difference Between an Appraisal Report and a Restricted Appraisal Report

November 14, 2025

When working with a real estate appraiser, one of the first and most important decisions involves determining the right type of report for your specific situation. Depending on the purpose of the appraisal and who will be using the results, there are two reporting formats to choose from under the 2024 Uniform Standards of Professional Appraisal Practice (USPAP): the Appraisal Report and the Restricted Appraisal Report.

Each format serves a distinct purpose. One offers full transparency and detailed documentation, while the other is more concise and suited to a single, knowledgeable user. Understanding the differences can help ensure the appraisal meets your needs and complies with regulatory standards.

Explaining the Report Types

Appraisal Report

The Appraisal Report is the most common and widely accepted format. It is built to accommodate multiple users and offers a comprehensive look into how the appraiser arrived at their conclusions.

This report type includes a detailed explanation of the property’s characteristics, the appraiser’s analysis. Readers can expect to find a full narrative on the property’s highest and best use. It also provides a breakdown of the valuation methods, and the rationale behind the selected approach.

Because this format provides full transparency, it is often required in situations where legal or financial documentation is necessary, or when the appraisal must be reviewed by multiple parties.

Restricted Appraisal Report

In contrast, the Restricted Appraisal Report is a more streamlined option. It is only suitable when there is a single intended user, and that user is already familiar with real estate concepts or the property in question.

This report provides the appraiser’s conclusion, but with summarized support and a limited explanation of the underlying analysis. It is not meant to be shared with others, and the document will include a disclaimer that it is intended solely for the client’s use.

While it lacks the depth and detail of a full Appraisal Report, the Restricted format can be a cost-effective and efficient tool for internal decision-making, especially when speed or simplicity is a priority.

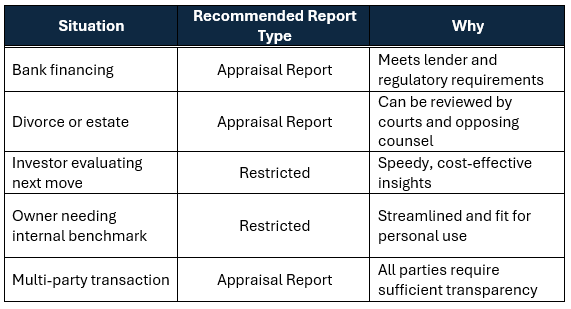

When to Use Each Report

Regional Relevance for Central California and the Central Coast

Appraisal decisions vary across the regions we serve. In San Luis Obispo County, estate settlements and vineyard appraisals often involve several attorneys and heirs. [These situations call for] the Appraisal Report because it provides the documentation needed for legal clarity. A Restricted Report may suit a long-time property owner who wants an updated value for planning purposes.

Across Central California and the Central Coast, choosing the right report often comes down to one question: Will this report be shared with others, or is it for internal use only? The answer usually determines which format fits best.

Final Thoughts

Choosing the correct appraisal report format is more than a preference. It affects compliance, legal standing, and how useful the valuation will be over time.

- Use the Appraisal Report when you need transparency, defensibility, and a document that others will review.

- Choose the Restricted Appraisal Report when you are the only user and do not need extensive analysis.

Selecting the right format ensures the appraisal serves its intended purpose and remains compliant with USPAP.

About Central California Appraisals

Since 1997, we have delivered real estate appraisals across Central California and the Central Coast with a focus on accuracy, objectivity, and professionalism. We serve a broad range of clients including banks, attorneys, private property owners, and public agencies. From Bakersfield to San Luis Obispo, and 12 other surrounding counties, our team of certified general and residential appraisers brings unmatched expertise in both commercial, agricultural, and residential valuation.

We are proud to be a trusted name for high-quality appraisals that support confident decision-making and meet the demands of lenders, courts, and private clients alike.

Leave a Reply Cancel reply

follow us on

@ccappraisals